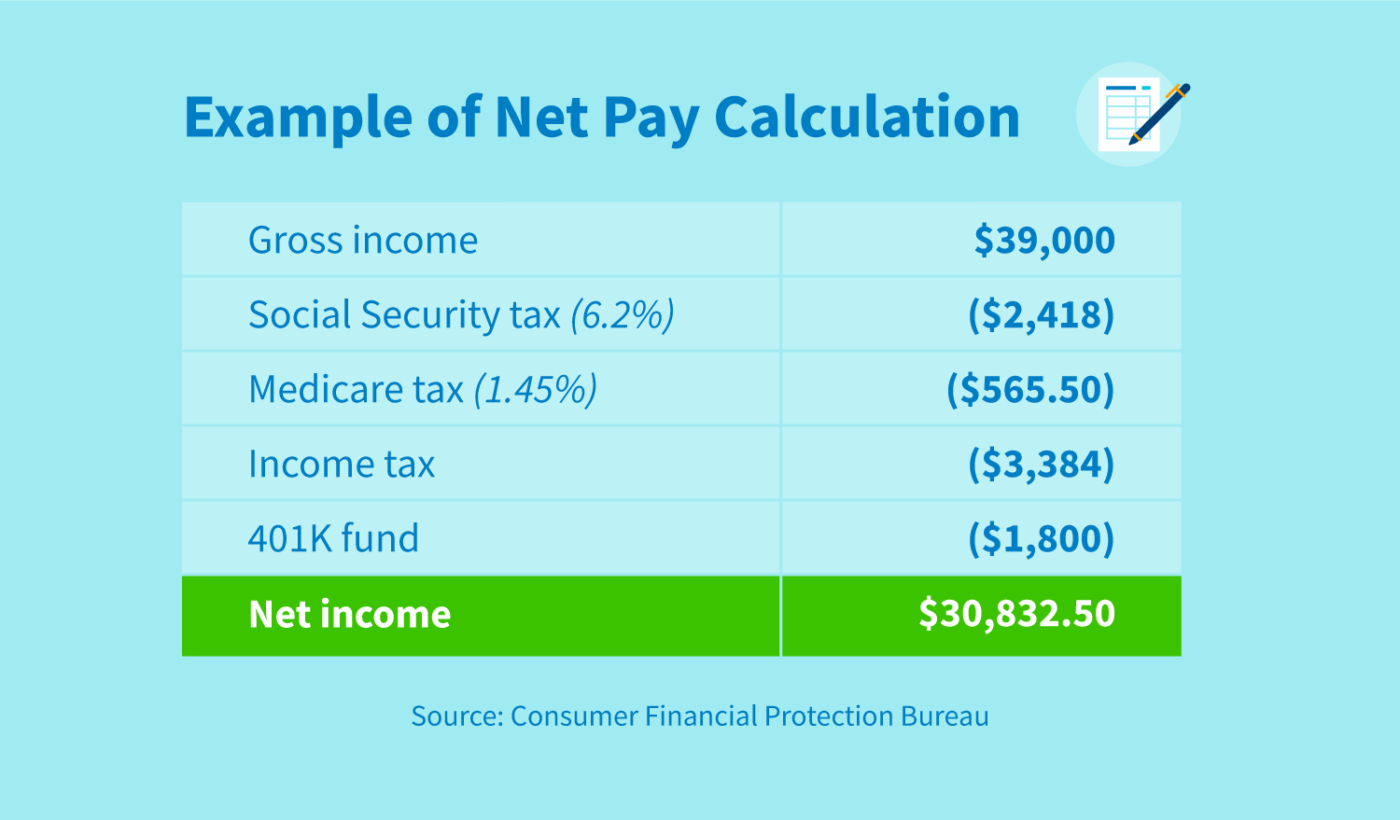

If you only work one salaried job, have no other income, and receive no bonuses, you can get your gross income by multiplying your monthly gross pay by 12. For example, if you are paid a gross monthly income of $3,000, simply multiply by 12 to arrive at the answer of $36,000.. Updated: Apr 12, 2024. Written By: Maria Edwards. Edited By: Katie Gray. Gross pay and net pay both appear on employee paychecks. Gross pay is an employee's earned wages before deductions. By.

What are Gross Wages? HR Glossary AIHR

What is the difference between gross and net pay Early Retirement

Gross vs. Net Pay What's the Difference?

Gross Pay Vs Net Pay What's the Difference? Hustle Inspires Hustle

Gross Pay Vs Net Pay What's the Difference? Hustle Inspires Hustle

Gross Pay vs Net Pay Is Gross Before or After Taxes? Money Bliss

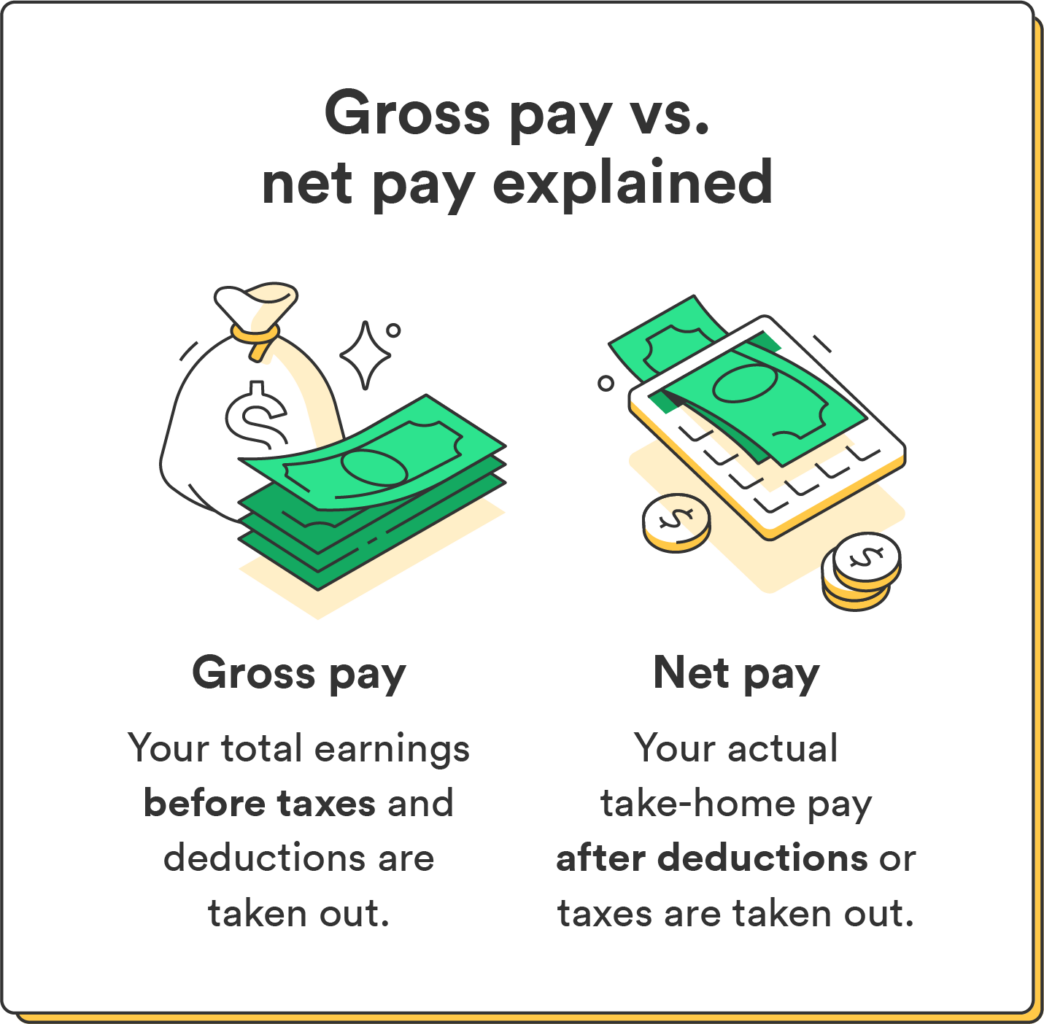

Gross Pay vs Net Pay Explained Chime

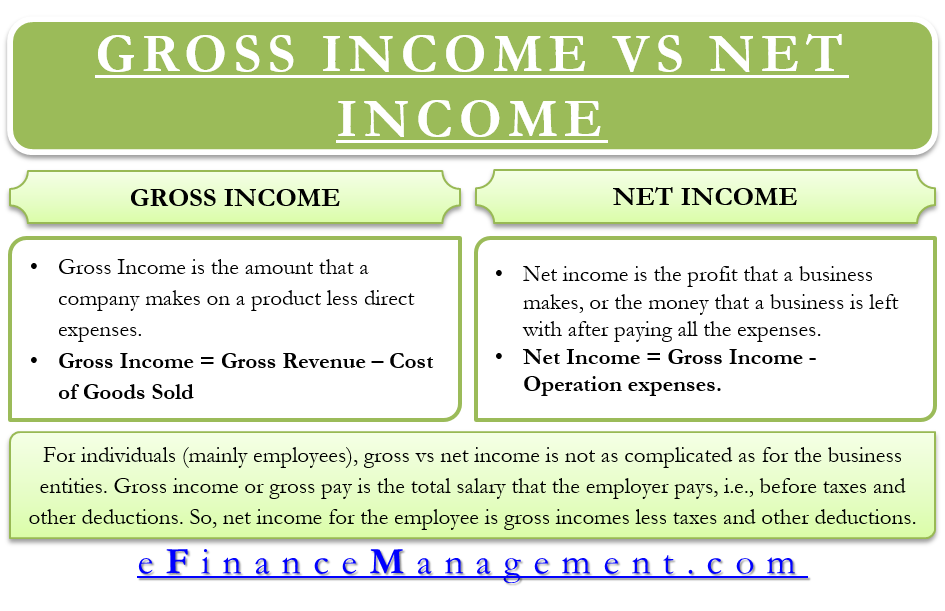

Gross vs. Net

Gross Pay vs Net Pay How to Budget Your The Right Way

.jpg)

Gross Pay Vs. Net Pay

Gross Pay Vs. Net Pay What’s the Difference? APS Payroll

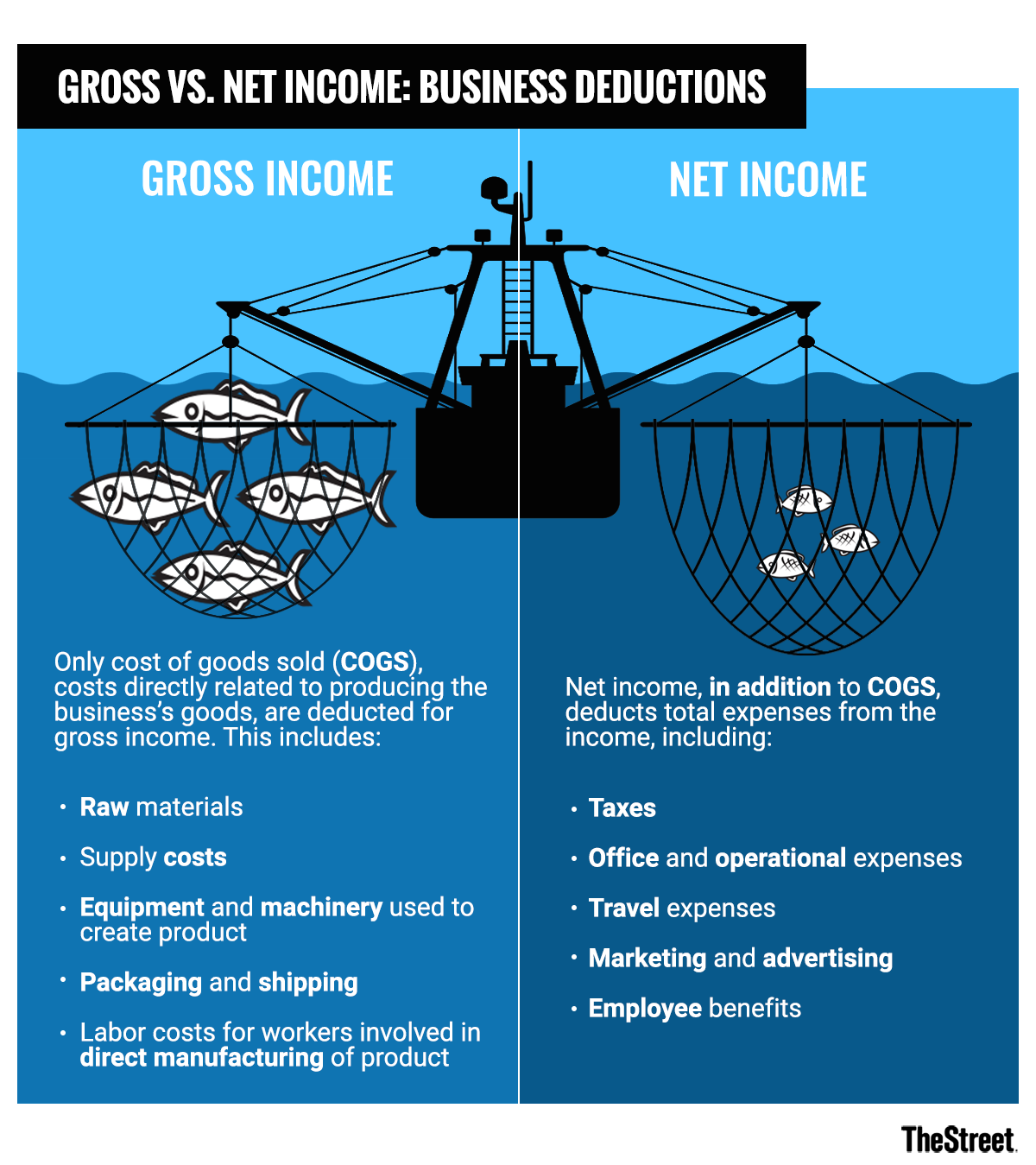

Gross vs Net Margin, and Domestic Product Business Terms

Gross Pay vs Net Pay What’s the Difference and How to Calculate Both Wrapbook

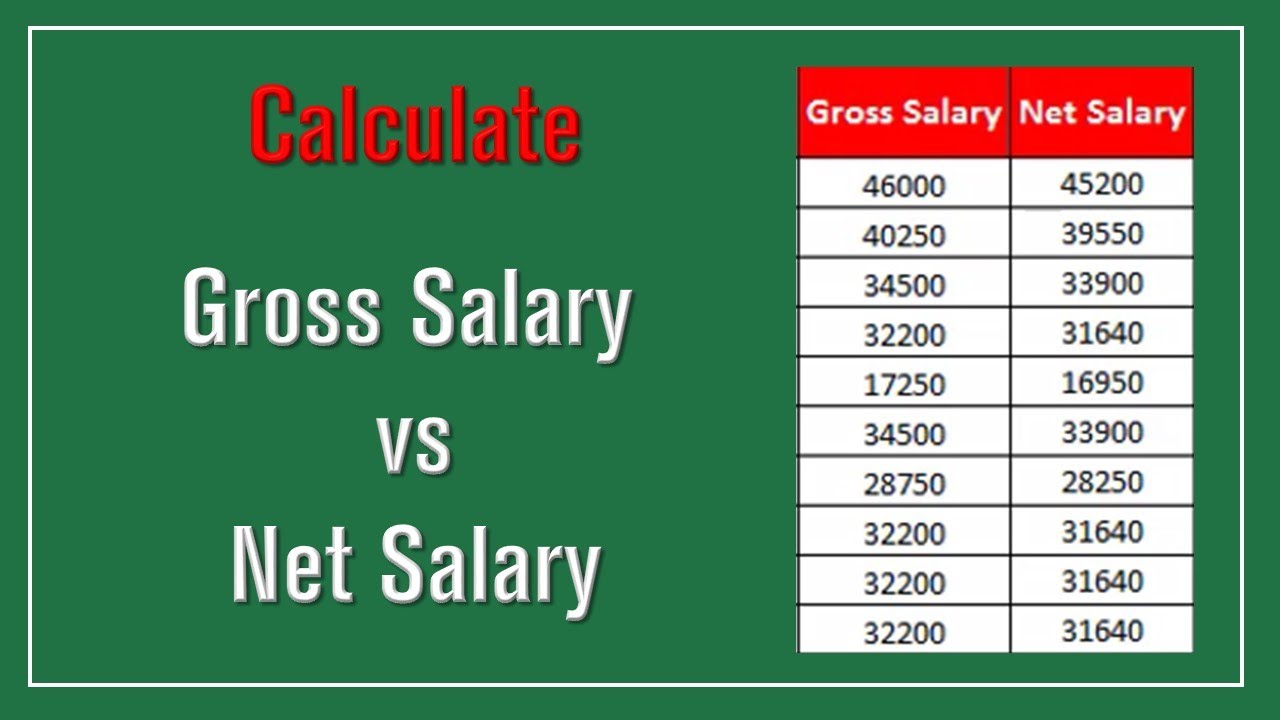

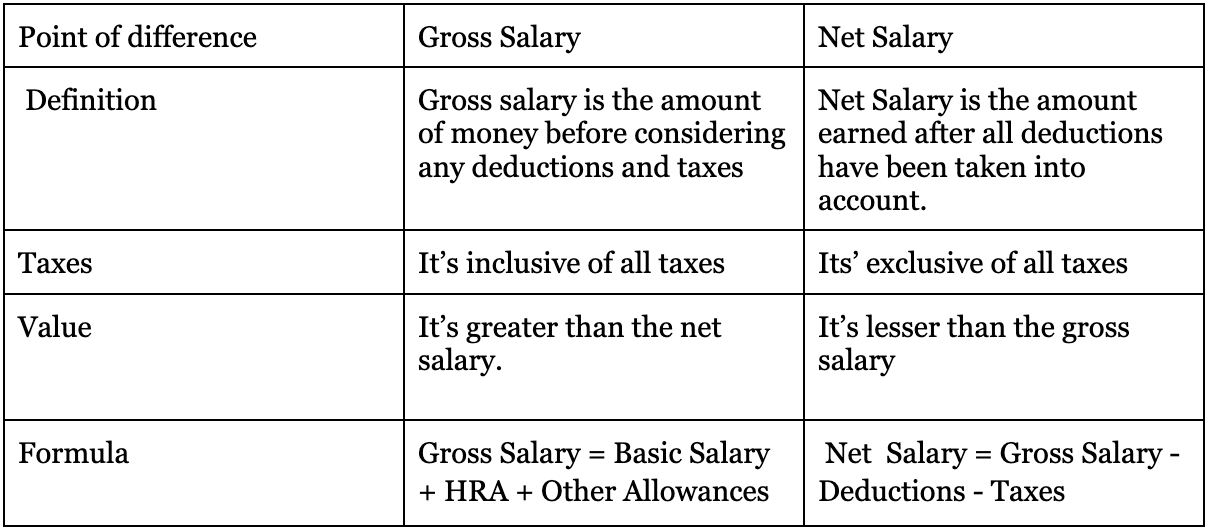

Gross Salary Vs Net Salary Major Comparison & Difference Between Gross & Net Salary

Gross Salary vs. Net Salary What are the main differences?

Gross Pay vs Net Pay Difference and Comparison

Gross Pay vs. Net Pay A Deep Dive to Help Simplify Payroll

Understanding gross pay

Gross Salary vs. Net Salary Key differences, Components and Calculation

Gross Pay Vs Net Pay Understanding and Calculating the Difference

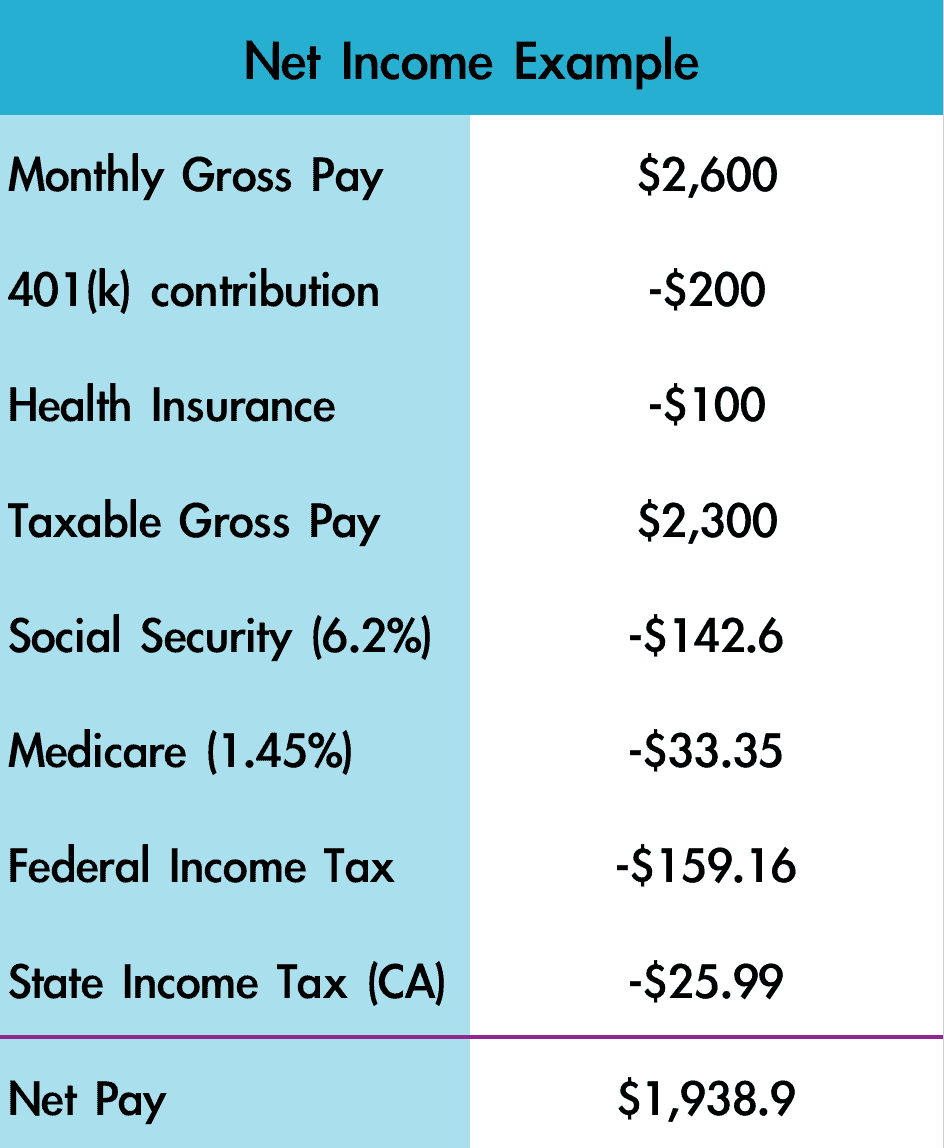

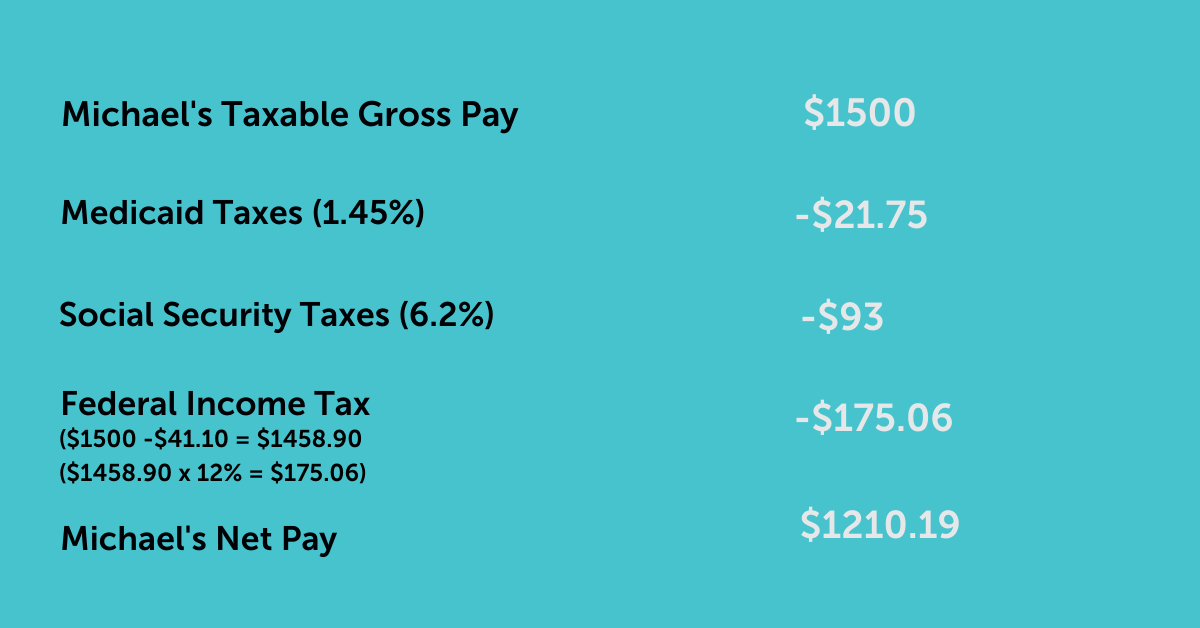

Knowing the difference between gross pay and net pay is one of the first steps when determining your business's budget,. a $40,000 salary results in gross pay of $3,333 monthly or $769 weekly.. Gross pay forms the basis for calculating an employee's net pay, the amount the employee takes home after all deductions. What Goes Into Gross Pay Gross pay typically includes regular pay, bonuses, and overtime pay, but may also involve other forms of compensation such as commissions, profit-sharing, and non-taxable benefits.